|

CARBON TAX

|

|

HOME | BIOLOGY | FILMS | GEOGRAPHY | HISTORY | INDEX | INVESTORS | MUSIC | SOLAR BOATS | SPORT |

|

A carbon tax is a tax on energy sources which emit carbon dioxide into the atmosphere. It is an example of a pollution tax, which some economists favor because they tax a "bad" rather than a "good" (such as income). Because a carbon tax addresses a negative externality, it is classed as a Pigovian tax, named after Arthur Pigou, who first proposed targeted taxation as a corrective to externalities.

Because of the link with global warming, a carbon tax is sometimes assumed to require an internationally administered scheme; that is not intrinsic to the principle, however. The European Union has discussed a carbon tax covering its member states to supplement the carbon emissions trading scheme begun in January 2005. However, emissions trading systems do not constitute a Pigovian tax insofar as (a) the payment for emissions is not received by a governmental body, and (b) the price per unit of emissions is not fixed as it is in tax systems, rather it is a market price that fluctuates.

The purpose of a carbon tax is environmental, to reduce emissions of carbon dioxide and thereby slow global warming. It can be implemented by taxing the burning of fossil fuels — coal, petroleum products such as gasoline and aviation fuel, and natural gas — in proportion to their carbon content. Unlike competing market-based approaches such as carbon cap-and-trade systems, little new administrative machinery would be required to administer and levy a carbon tax.

Smoke and ozone pollution from Indonesian fires 1997

Background

In economic theory, pollution is considered a negative externality because it has a negative effect on one or more parties not directly involved in a transaction. For instance, a power plant or motor vehicle emitting carbon dioxide would be a source of a negative externality. A negative externality represents part of the social cost of production that is not incorporated into the private cost of producers. As a result, firms would consider it cheaper to pollute than to find other means of production, because not all the costs of production have been "internalized."

To address this problem, Pigou proposed a tax on the good — in this case fossil fuel energy — whose production was the source of the negative externality (carbon dioxide) so as to accurately reflect the cost of the good's production to society, thereby internalizing the costs associated with the good's production. A tax on a negative externality is termed a Pigouvian tax.

The carbon tax is an indirect tax — a tax on a transaction — as opposed to a direct tax, which taxes income. As a result, some American conservatives have supported the carbon tax because it taxes at a fixed rate, independent of income, which would dovetail with their support of a flat tax.

Prices of carbon (fossil) fuels are expected to continue increasing as more countries industrialize and available fuel supplies are depleted. In addition to creating incentives for energy conservation, a carbon tax would put renewable energy sources such as wind, solar and geothermal on a more competitive footing stimulating their growth. Former Federal Reserve chairman Paul Volcker suggested (February 6, 2007) that "it would be wiser to impose a tax on oil, for example, than to wait for the market to drive up oil prices." [1]

Social cost of carbon

Many estimates of aggregate net economic costs of damages from climate change across the globe, the social cost of carbon (SCC), expressed in terms of future net benefits and costs that are discounted to the present, are now available. Peer-reviewed estimates of the SCC for 2005 have an average value of US$43 per tonne of carbon (tC) (i.e., US$12 per tonne of carbon dioxide) but the range around this mean is large. For example, in a survey of 100 estimates, the values ran from US$-10 per tonne of carbon (US$-3 per tonne of carbon dioxide) up to US$350/tC (US$95 per tonne of carbon dioxide.)

One must be very careful when comparing weights of carbon versus carbon dioxide, since carbon comprises only 27.29% (12.0107/(12.0107+15.9994*2)) of the mass of carbon dioxide. In simple terms, there are only 27 tonnes of carbon in 100 tonnes of carbon dioxide.

In an October, 2006, report entitled the Stern Review by the former Chief Economist and Senior Vice-President of the World Bank, Nicholas Stern, he states that climate change could affect growth which could be cut by one-fifth unless drastic action is taken. Stern has warned that one percent of global GDP is required to be invested in order to mitigate the effects of climate change, and that failure to do so could risk a recession worth up to twenty percent of global GDP. Stern’s report suggests that climate change threatens to be the greatest and widest-ranging market failure ever seen. The report has had significant political effects: Australia reported two days after the report was released that they would allot AU$60 million to projects to help cut greenhouse gas emissions. The Stern Review has been criticized by economists, saying that Stern did not consider costs past 2200, that he used an incorrect discount rate in his calculations, and that stopping or significantly slowing climate change will require deep emission cuts everywhere.

According to a 2005 report from the Association of British Insurers, limiting carbon emissions could avoid 80% of the projected additional annual cost of tropical cyclones by the 2080s. A June 2004 report by the Association of British Insurers declared "Climate change is not a remote issue for future generations to deal with. It is, in various forms, here already, impacting on insurers' businesses now." It noted that weather risks for households and property were already increasing by 2–4 % per year due to changing weather, and that claims for storm and flood damages in the UK had doubled to over £6 billion over the period 1998–2003, compared to the previous five years. The results are rising insurance premiums, and the risk that in some areas flood insurance will become unaffordable for some.

In the U.S., according to Choi and Fisher (2003) each 1% increase in annual precipitation could enlarge catastrophe loss by as much as 2.8%. Financial institutions, including the world's two largest insurance companies, Munich Re and Swiss Re, warned in a 2002 study that "the increasing frequency of severe climatic events, coupled with social trends" could cost almost US$150 billion each year in the next decade. These costs would, through increased costs related to insurance and disaster relief, burden customers, taxpayers, and industry alike.

Equity Issues

Any flat tax is economically superior to other taxes, but the regressivity of a carbon tax could be minimized or eliminated by allocating the tax revenues to benefit the less affluent. Wealthier households use more energy, on average — they drive and fly more, have bigger (and sometimes multiple) houses, and buy more products that require energy to manufacture and use. Most carbon tax revenues will therefore come from families of above-average means, as well as corporations and government. This creates a basis for progressive tax-shifting: transferring a portion of the tax burden from regressive taxes such as the payroll tax (at the federal level) and the sales tax (at the state level) onto pollution and pollution-generating activities.

Another progressive approach in the United States is to rebate the carbon tax revenues equally to all U.S. residents — a national version of the Alaska Permanent Fund [2], which once a year sends identical checks to all state residents from the state’s North Slope oil royalties. Because income and energy consumption are strongly correlated, most poorer households would get more back in rebates or tax savings than they would pay in the carbon tax.

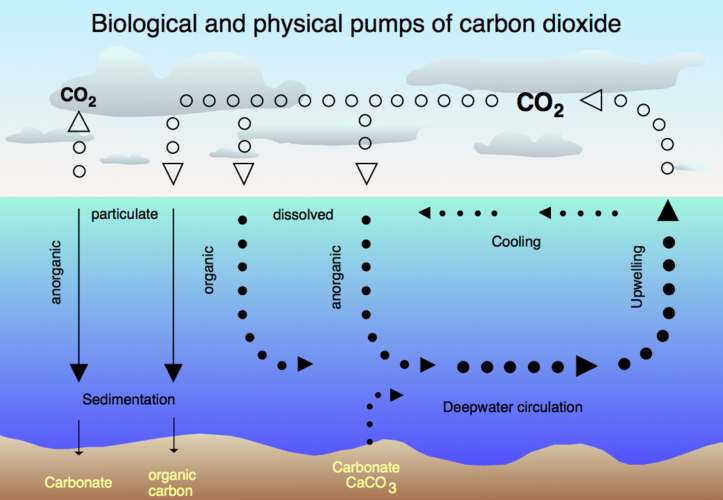

Air-sea exchange of CO2

Border Issues

Concerns have been raised about carbon leakage which is the tendency for energy-intensive industries to migrate from nations with a carbon tax to those nations without a carbon tax where some of the receiving nations might be less energy-efficient. A possible antidote is for carbon-taxing countries to levy carbon-equivalent fees on imports from non-taxing nations. There is also the hope that American leadership through carbon-taxing would be reciprocated by other countries with an equal stake in climate protection.

Tax Rates

Start with some handy facts:

Petroleum (motor gasoline, diesel, jet fuel)

Emissions total about 20 pounds of CO2 per gallon, so a tax of $100 per ton of CO2 would translate to a tax of about $1.00 per gallon. (To be precise: motor gasoline emits 19.564 pounds of CO2 per gallon, diesel emits 22.384 pounds of CO2 per gallon, and jet fuel emits 21.095 pounds of CO2 per gallon[4]. So a tax of $100 per ton of CO2 translates to a tax of $0.978 per gallon of gasoline, $1.119 per gallon of diesel, and $1.055 per gallon of jet fuel.) At a price of between $2 and $5 per gallon, a tax of $100 per ton of CO2 would raise gas prices by 20-50%.

For the purpose of looking at electricity generation: emissions total about 155 pounds of CO2 per million BTUs, so a tax of $100 per ton of CO2 translates to a tax of about $7.75 per million BTUs. (To be precise: motor gasoline emits 156.425 pounds of CO2 per million BTUs, diesel emits 161.386 pounds of CO2 per million BTUs, and jet fuel emits 156.258 pounds of CO2 per million BTUs[5]. So a tax of $100 per ton of CO2 translates to a tax of $7.82 per million BTUs of gasoline, $8.07 per million BTUs of diesel, and $7.81 per per million BTUs of jet fuel.)

Natural gas

Emissions total 120.6 pounds of CO2 per thousand cubic feet, i.e., 60.3 tons per million cubic feet, so a tax of $100 per ton of CO2 translates to a tax of $6.03 per thousand cubic feet of natural gas[6]. At a price of between $4 and $10 per thousand cubic feet, a tax of $100 per ton of CO2 would raise natural gas prices by 60-150%.

For the purpose of looking at electricity generation: emissions total 117.08 pounds of CO2 per million BTUs[7], so a tax of $100 per ton of CO2 translates to a tax of $5.854 per million BTUs.

Coal

Emissions per ton of coal range from 1.40 tons of CO2 to 2.84 tons of CO2, depending on the type of coal (1.40 for lignite, 1.86 for subbituminous, 2.47 for bituminous, and 2.84 for anthracite, to be precise[8]), so a tax of $100 per ton of CO2 translates to a tax of between $140 and $284 per ton of coal, depending on the type ($140 for lignite, $186 for subbituminous, $247 for bituminous, and $284 for anthracite). The price of coal delivered to electric utilities nationwide averaged $27.34 per ton in 2004"; for that price, a tax of $100 per ton of CO2 means a price increase of 500-1000% depending on the type (512% for lignite, 680% for subbituminous, 903% for bituminous, and 1039% for anthracite).

Because of the differences in the carbon content of different types of coal, it is easier to do the calculations in terms of BTUs rather than tons of coal. So: Emissions per million BTUs range from 205 to 227 pounds of CO2 per million BTUs (215.4 for lignite, 212.7 for subbituminous, 205.3 for bituminous, and 227.4 for anthracite, to be precise[9]), so a tax of $100 per ton of CO2 translates to a tax of about $10 per million BTUs, depending on the type of coal ($10.77 for lignite, $10.635 for subbituminous, $10.265 for bituminous, and $11.37 for anthracite).

Electricity

The impact of a carbon tax on electricity prices depends on the amount of CO2 generated along with the electricity, and that depends on the type of fuel used and the efficiency ("heat rate") of the generator. 3413 BTU = 1 kWh.

In terms of fuel use, note from above that CO2 emissions per million BTUs (293 kWh) range from 117.08 pounds of CO2 for natural gas and about 155 pounds of CO2 for petroleum to between 205 and 227 pounds of CO2 for coal, and that a tax of $100 per ton of CO2 therefore translates into a tax per million BTUs that ranges from $5.854 per million BTUs for natural gas and about $7.75 per million BTUs for petroleum to between $10.27 and $11.37 per million BTUs for coal. For comparison purposes: in 2005, fuel prices to electricity generators per million BTU were $7.70 for oil, $8.18 for natural gas, $1.53 for coal, and $0.48 for nuclear[10] [11]. Current electricity prices are in the neighborhood of $0.08 per KWh.

Old-style generators have a heat rate in the ballpark of 10,000 BTUs per KWh[12] [13]. At that heat rate, a tax of $100 per ton of CO2 translates into a tax of $0.05854 per KWh for natural gas, about $0.0775 per KWh for petroleum, and between $0.1027 and $0.1137 per KWh for coal. As noted above, current electricity prices are in the neighborhood of $0.08 per KWh.

New-style combined-cycle gas turbines currently (2005) use 6,572 BTUs per KWh (51.93% efficient), a number that is expected to decline to 6,333 by 2015[14]. At these heat rates, a tax of $100 per ton of CO2 translates into a tax of $0.0385 per KWh for natural gas using 2005 technology and a tax of $0.0371 per KWh for natural gas using 2015 technology.

New-style combined-cycle coal gasification units currently (2005) use 8,309 BTUs per KWh (41.08% efficient), a number that is expected to decline to 7,200 by 2015[15]. At these heat rates, a tax of $100 per ton of CO2 translates into a tax of between $0.0853 and $0.0945 per KWh for coal using 2005 technology and a tax of between $0.0739 and $0.0819 per KWh for coal using 2015 technology.

Implementation

On January 1, 1991, Sweden enacted a carbon tax, placing a tax of .25 SEK/kg ($100 per ton) on the use of oil, coal, natural gas, liquefied petroleum gas, petrol, and aviation fuel used in domestic travel. Industrial users paid half the rate (between 1993 and 1997, 25% of the rate), and certain high-energy industries such as commercial horticulture, mining, manufacturing and the pulp and paper industry were fully exempted from these new taxes. In 1997 the rate was raised to .365 SEK/kg ($150 per ton) of CO2 released.[16]

Finland, the Netherlands, and Norway also introduced carbon taxes in the 1990s.

In 2005 New Zealand proposed a carbon tax, setting an emissions price of NZ$15 per tonne of CO2-equivalent. The planned tax was scheduled to take effect from April 2007, and applied across most economic sectors though with an exemption for methane emissions from farming and provisions for special exemptions from carbon intensive businesses if they adopted world's-best-practice standards of emissions. After the 2005 election, the minor parties supporting the Government opposed the proposed tax, and it was abandoned in December 2005.

In 1993, President of the United States, Bill Clinton proposed a BTU tax that was never adopted. His Vice President, Al Gore, had strongly backed a carbon tax in his book, Earth in the Balance, but this became a political liability after Gore's Republican opponents attacked him as a "dangerous fanatic". In 2000, when Gore ran for President, one commentator labeled Gore's carbon tax proposal a "central planning solution" harking back to "the New Deal politics of his father." In April 2005, Paul Anderson, CEO and Chairman of Duke Energy, called for the introduction of a carbon tax.[17] In January 2007, economist Charles Komanoff and attorney Dan Rosenblum launched a Carbon Tax Center[18] to give voice to Americans who believe that taxing carbon emissions is imperative to reduce global warming.

LINKS and REFERENCE

A taste for adventure capitalists

Solar Cola - a healthier alternative

|

|

This

website

is Copyright © 1999 & 2007 NJK. The bird |

|

AUTOMOTIVE | BLUEBIRD | ELECTRIC CARS | ELECTRIC CYCLES | SOLAR CARS |